Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Message Optional. Options trading capabilities are fairly simple, and there is little help for choosing a strategy. Investing Brokers. M1 Finance: Smart Money Management.

Whether you trade a lot or a little, we can help you get ahead

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to traving identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. This is Fidelity trading apps Tech. Commission-free trades.

Account Options

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Prefer to manage your portfolio on the go?

A full service broker vs. a free trading pioneer

Important legal information about the email you traidng be sending. By using this service, you agree to input your real email address and only send it to people you know.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity trading apps solely for the purpose of sending the email on your behalf.

The subject line of the email you send will be «Fidelity. This is Decision Tech. Commission-free trades. Get margin rates as low as 5. Great rates on cash. Your cash automatically gets swept into our trding market fund when you open a retail brokerage or retirement account.

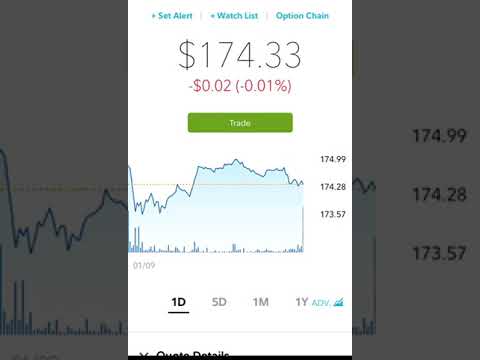

Decision-making technology. Get smarter trading technology and dedicated support to help inform your trading decisions.

Broad choice of investments. Industry-leading execution quality. New to trading? Start. Table compares pricing for retail investors. Money market funds are not insured or guaranteed by the FDIC or any other government agency.

Consider tradint product carefully. Performance data shown represents past performance and is no guarantee of future results. Current performance may be higher or apos than that quoted.

Visit Fidelity. Compare us to your online broker. Not a Fidelity customer? Try our research, tools, and more without opening an account. Sign up for free Guest Access. What’s new in brokerage We’re committed to making your saving, investing, and trading experience even better.

See our latest enhancements. Don’t miss out on investing insights Stay notified about upcoming live Fidelity webinars. Subscribe today. Chat with an investment professional. Find an Investor Center. Options trading entails significant risk and is not appropriate for all investors.

Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options.

Supporting documentation for any claims, if applicable, will be furnished upon request. The comparison is based on an analysis of price statistics that include all SEC Rule eligible market and marketable limit orders of —1, shares.

For both the Fidelity and Industry savings per order figures used in the example, the figures are calculated by taking the average savings per share for the eligible trades within the respective order size range and apos each byfor consistency purpose. Fidelity’s average retail order size for SEC Apps eligible orders —9, shares during this time period was shares. The average retail order size for the Industry for the same shares range and time period was shares.

Price improvement examples are based on averages and any price improvement amounts related to your trades will depend on the particulars of your specific trade. Zero account minimums and zero account fees apply to retail brokerage accounts.

Expenses charged by investments e. See Fidelity. ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

Fidelity’s current base margin rate is 8. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors.

Please assess your financial circumstances and risk tolerance before trading on margin. Results based fidelity trading apps having the highest Customer Experience Index within the categories composing the survey, as scored by 5, respondents.

All rights tradng. Fidelity was also rated No. Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an fidelit to buy, or a recommendation for the security.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money. Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information.

Read it carefully. As with any search engine, we ask that you not input personal or account information. Information that you input is not stored or reviewed for any purpose other than to provide search results. Responses provided by the virtual assistant are to help you navigate Fidelity.

Fidelity does not guarantee accuracy of results or suitability of information provided. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice.

Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Skip to Main Content. Search fidelity. Investment Products. Why Fidelity. Print Email Email.

Send to Separate multiple email addresses with commas Please enter a xpps email address. Your email address Please enter a valid email address.

Message Optional. Trading at Fidelity. Open a brokerage account. Whether you trade a lot or a little, we can help you get ahead. Choice and transparency. Our trading account. This full-featured brokerage account can meet your needs as you grow as an investor. Launch into better trading strategies. Rated 1 for Overall — Best Online Broker See the Fidelity advantage for. Yield may vary due to market conditions.

Discover your next investing strategy. Ready to get started? Call anytime: Fideilty fee is subject to change. Other exclusions and conditions may apply. You could lose money by investing in the fund.

An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Fidelity Brokerage Services receives compensation from the fund’s advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers «Marketing Program».

Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. Please note that this security will note be marginable for 30 days from tradinng settlement date, at which time it will automatically become eligible for margin collateral. Yields may vary due to market conditions. The Fidelity fund yield is the average amount earned by the fund after expenses over the past seven days, annualized as of the website published date indicated.

You should know that money market funds have different characteristics than bank sweep products and savings accounts; read the fund’s prospectus carefully. An important difference is that bank sweep products have FDIC protection, which guarantees principal and interest within limits. For further info, see Fidelity. APY is the amount of total interest earned on a bank product in one year.

Next generation, industry-first functionality

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Please enter a valid ZIP code. Reviews Review Policy. The latest version includes: Bug Fixes and performance enhancements Your feedback helps us improve your experience fidelity trading apps ongoing updates. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Check out our enhanced mobile check deposit All Rights Reserved. Your Money. The firm does not hold live events and has no plans for webinars. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Android and Google Play are trademarks of Google Inc. Visit website. If you’re not using the margin you’re paying for, the cost can be quite high.

Comments

Post a Comment